From the very beginning, our mission at Income Insurance has been to provide essential financial protection to the people of Singapore. Income is dedicated to safeguarding your financial well-being, and that of our nation. We go above and beyond to ensure the security and prosperity of all groups in the community, including the vulnerable and the underserved.

Today, Income continues to stand by Singapore. We are committed to Singapore’s progress, supporting your courage and strength to forge ahead.

Because you possess what it takes to fight on — the courage to pull through tough times. And we will continue to provide the financial protection to ensure you can.

Income Insurance.

Protecting Singapore. Serving Singapore.

Protecting Seniors

Protecting Gig Workers

Protecting Mental Health

Financial protection for the growing number of seniors in Singapore.

For seniors who need essential insurance coverage, Income provides them the option to get coverage even at an entry age of 74#.

SilverCare

Comprehensive protection for ageing well with an entry age as high as 75, and is renewable for life[1] with no maximum renewal age.

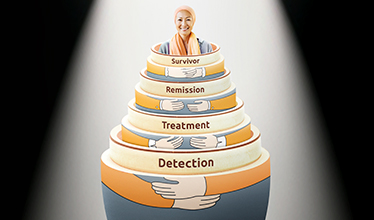

Complete Cancer Care

Continuous care throughout the cancer journey, from diagnosis to recovery, with entry age as high as 74.

Gro Cash Plus

Capital-guaranteed[2] insurance savings plan with a lifetime of cash payouts[3] from the end of 3rd policy year till age 120, and has a maximum entry age (age last birthday) of 75.

TermLife Solitaire

Financial legacy protection with coverage up to age 100[4]. Entry age as high as 74 years[5].

Enhanced PreX Travel

Comprehensive coverage for those with pre-existing medical conditions, including diabetes and heart conditions.

# The entry age to purchase Complete Cancer Care is as high as 74 and the entry age to purchase SilverCare is as high as 75. Policy Ts&Cs apply.

^ Promo and policy Ts&Cs apply.

* This premium rate is based on 20% off for Basic plan, aged 50 to 75 and rounded to the nearest cents.

[1] Your policy will be renewed as long as:

- the eligibility requirements are met

- claims have not reached the lifetime limit allowed for the respective plans

- the full sum insured under the final expenses or permanent disability benefits have not been claimed.

[2] At the end of the premium term, if the policyholder did not cash in this policy and all premiums for this policy have been paid for, the guaranteed cash value for this policy is equal to the total premiums paid, excluding premiums paid on riders. If the policyholder chooses to cash in this policy partially, the sum assured after the partial cash payout cannot be less than the minimum sum assured limit or any other amount Income Insurance may tell the policyholder about. Income Insurance will use the new sum assured and reduced regular premium amount, excluding premiums paid on riders, to work out the guaranteed cash value (if any) from the policy entry date.

[3] If the insured survives at the end of the premium term, and if all premiums for this policy have been paid for, Income Insurance will start paying the cash benefit at the end of the premium term. Income Insurance may pay a cash bonus on top of each cash benefit by applying a bonus rate to the sum assured. Income Insurance may or may not pay this cash bonus for each policy year. The percentage of the sum assured for the yearly cash benefit is dependent on the policy entry age of the original insured. If the sum assured of the policy is at least $80,000, you can choose to receive the yearly cash payouts in monthly payments. You cannot change the frequency you receive the cash benefit (yearly or monthly) after the first cash benefit is paid out. If Income Insurance pays a cash bonus on top of a cash benefit, Income Insurance will treat the cash bonus and its cash benefit as one cash benefit. Please refer to the policy conditions for further details.

[4] Covered up to age 100 (last birthday).

[5] Maximum entry age of 74 (last birthday) for the following coverage periods, subject to the maximum coverage age of 100 (age last birthday):

- 10 years

- 15 years

- 20 years

- 25 years

- Up to age 84

- Up to age 100

- Maximum entry age of 70 (last birthday) for 30 year coverage period.

- Maximum entry age of 65 (last birthday) for 35 year coverage period.

- Maximum entry age of 60 (last birthday) for 40 year coverage period.

- Maximum entry age of 64 (last birthday) for coverage period up to age 74.

- Maximum entry age of 54 (last birthday) for coverage period up to age 64.

[6] The Mental Benefit covers you against 5 mental conditions like major depressive disorder and obsessive compulsive disorder before age 75, and Tourette syndrome before age 21.

For policies issued by us that include Special Benefit or Special and Mental Benefit, we will pay no more than $30,000 for the same condition or procedure for each insured, no matter how many of such policies we have issued to cover the same insured. Please refer to the policy conditions for further details.

We will not pay this benefit if the insured suffered symptoms of, had investigations for, or was diagnosed with the disease any time before or within 90 days from the cover start date. The insured must survive for at least seven days from the date of diagnosis, or after having the medical procedure, before we pay this benefit.

Disclaimers

Do not attempt to recreate or perform any of the stunts shown. All stunts were performed by professionals in controlled environments. Letter of settlement shown on film is for illustration only. This video is owned by Income Insurance Limited and protected by copyright. No party shall copy, reproduce, modify, rent, publish, broadcast, transmit, redistribute, store, use or exploit this video or any part of it without Income Insurance’s prior written consent. Unauthorised or unlawful use of this video will result in legal action.

This is for general information and does not constitute an offer, recommendation, solicitation, or advice to buy or sell any product(s). Please refer to the policy contract for details. You should seek personalised financial advice before you purchase any insurance product. Otherwise, you may end up buying a plan that does not meet your expectations or needs. As a result, you may not be able to afford the premiums or get the insurance protection you want. Buying a life insurance plan is a long-term commitment on your part. If you cancel your plan prematurely, the cash value you receive (if applicable) may be zero or less than the premiums you have paid for the plan. If you find that this plan is not suitable after purchasing it, you may terminate it within the free-look period and obtain a refund of premiums paid. We may recover from you any expense incurred in underwriting this plan (subject to the respective products’ terms and conditions).

(Applicable for products that fall under the Policy Owners’ Protection Scheme)

These policies are protected under the Policy Owners’ Protection Scheme, which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Income or visit the GIA/LIA or SDIC websites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information is correct as at 12 August 2024.