I’m Just 53 but I’m Already Feeling the Pressure to Retire

The workplaces of today are a reflection of the progress we have made as a society over the years. Yes, we have certainly come a long way in embracing greater diversity and inclusion in our workplaces, such as increasing the representation of women in the workforce. However, there still exists subtle signs of ageism that can push even the most seasoned professionals to the side-lines.

As a 53-year-old working professional, I can attest to experiencing subtle (and not-so-subtle) nudges first-hand at my workplace that make me feel like my time to sit out on the benches and fade into retirement is approaching, although I feel I still have much to contribute career-wise.

Feeling 'overly mature' in the workplace

With more than two decades of professional experience, I have worked my way up from Junior Executive to Senior Manager. During this time, I have been given several opportunities to work on a wide range of projects. Not only has this contributed to my personal growth and built my wealth of experience, it has also allowed me to gain recognition from my bosses.

But of late, I have started to feel that my experience and maturity are being viewed as secondary assets. Though I remain a committed and consistent performer, I find myself frequently getting passed over in favour of my younger colleagues to lead teams for new projects and receiving less face time with key clients.

Aside from that, my retirement plans have started to become a topic of conversation during work chats, such as whether I feel tired from working all these years and if I’m looking forward to taking a break and just enjoying life.

When I retire should be my choice

This got me thinking – has the sun begun to set on my career? Is now the time to start thinking about retiring? I know I’m not the only one to be caught in this dilemma, but I truly believe that I am still living out my prime with the desire to keep learning and contributing.

While I may have matured in age, this does not mean that my professional abilities have diminished. In fact, my wealth of experience, coupled with the latest know-hows of my younger colleagues, will be the key to success in our organisation. Therefore, deciding when to retire should be an individual's privilege, depending on one’s capabilities and circumstances.

Why I want to continue working

So yes, personally, I don’t feel ready to hang up my boots just yet for a couple of reasons – financial security being the first.

There are still daily expenses to pay for and indulgences such as eating out and taking family vacations that I’m not ready to give up. I also have two children with many more years of child-related expenses to bear before they start working and earning their own living. Furthermore, I want to save as much as possible for my retirement years, in order to make it as comfortable as I can possibly can.

Aside from that, work truly gives me a sense of purpose and satisfaction. I love that each day is different and presents new challenges which helps me to keep learning. This is a great way to keep my mind active.

How I plan to keep myself going

On this note, I do recognise the need to continually improve myself professionally and add further value to my organisation.

For a start, I have begun to check out SkillsFuture for training courses that can bring me up to speed on the latest trends and know-how in my field of work, such as in using cloud computing to enhance digital marketing strategies and in applying design thinking to managing teams. I can also prime myself to remain open to learning from my younger colleagues, especially with their strengths in staying on top of social media trends and bringing fresh perspectives, just to name a few.

At the same time, I am also thinking of joining my organisation’s mentoring programme so that I can impart my knowledge to younger colleagues in areas such as project and client management – right from understanding the brief to pitching to upselling.

Knowing that there will come a day when I’ll have to pivot in my career, I am also evaluating other career options. With my experience and reputation within my industry, I’m exploring the idea of starting up my own consultancy firm which I feel will provide me the flexibility to pursue personal interests and expand my social network.

Begin financial planning now, regardless of when you retire

If, like me, you’re soon approaching the traditional retirement age, don’t feel pressured to retire just because of societal norms. When to retire is ultimately your choice, contingent on your circumstances. However, the important thing to do is to ensure that you are prepared for retirement so that you will be financially secure to support whatever decision you make.

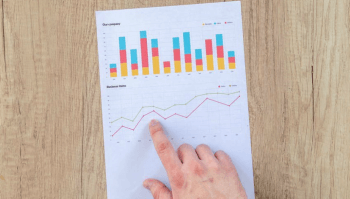

For a start, consider Income’s insurance savings plan, Gro Cash Sure, which is capital guaranteed1 and provides you a lifetime of cash payouts2 starting from the end of the premium term till age 120, as well as the flexibility to choose between 5 or 10 years for your premium term based on your lifestyle and retirement goals. If you're considering wealth accumulation for your child, Gro Cash Sure lets you appoint your loved one as a secondary insured3 so your policy can continue in the event of death of the insured.

If you are not sure about where to get started or which retirement plan suits you best, feel free to reach out to Income Insurance’s advisors today.

1 At the end of the premium term, if the policyholder did not cash in this policy and all premiums for this policy have been paid for, the guaranteed cash value for this policy is equal to total premiums paid, excluding premiums paid on riders. If the policyholder choose to cash in this policy partially, the sum assured after the partial cash payout cannot be less than the minimum sum assured limit or any other amount Income Insurance may tell the policyholder about. Income Insurance will use the new sum assured and reduced regular premium amount excluding premiums paid on riders to work out the guaranteed cash value (if any) from the policy entry date.

2 If the insured survives at the end of the premium term, and if all premiums for this policy have been paid for, Income Insurance will start paying the cash benefit at the end of the premium term. Income Insurance may pay a cash bonus on top of each cash benefit, by applying a bonus rate to the sum assured, and may include any loyalty bonus payable from the end of 20th policy year after the end of premium term. Income Insurance may or may not pay this cash bonus for each policy year. Each yearly cash benefit is 2% of the sum assured and the non-guaranteed cash bonus without loyalty bonus is 7.3% of your sum assured and with loyalty bonus is 7.9% of your sum assured (based on the assumption that the Life Participating Fund earns a long-term average return of 4.25% per annum). At an illustrated investment rate of return of 3.00% per annum, the non-guaranteed cash bonus without loyalty bonus is 4% of your sum assured and with loyalty bonus is 4.35% of your sum assured.

If the sum assured of the policy is at least $80,000, the yearly cash payouts can be received in monthly payments. Please refer to the policy contract for further details.

The above-mentioned percentages of the sum assured do not reflect the policy’s illustrated yield upon surrender. The sum assured in this plan is a notional value used to determine the cash benefit and non-guaranteed bonuses. It does not represent the amount payable upon death or diagnosis of terminal illness.

3 Only you as the policyholder (before the age of 65 years old), your spouse (before the age of 65 years old), or your child/ward (before the age of 18 years old) can be the secondary insured at the time you exercise this option. You can exercise this option to appoint a secondary insured no more than three times. Terms apply for the benefit. Please refer to the policy contract for further details.

This article is meant purely for informational purposes and does not constitute an offer, recommendation, solicitation or advise to buy or sell any product(s). It should not be relied upon as financial advice. The precise terms, conditions and exclusions of any Income Insurance products mentioned are specified in their respective policy contracts. Please seek independent financial advice before making any decision.

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Income Insurance or visit the GIA/LIA or SDIC websites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

.gif)